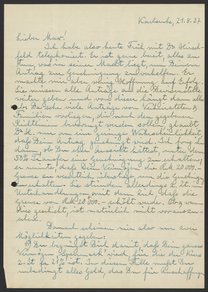

Correspondence between Georg Bredig to Max Bredig, circa 1935

- Decade starting 1935

Correspondence between Georg Bredig (1868-1944) and his son, Max Bredig (1902-1977), regarding income tax laws in Germany. Georg has copied an excerpt from the tax information sheet of the university association and asks how the situation applies to Max.

Georg is likely reflecting on The Reich Flight Tax (Reichsfluchtsteuer), a German law implemented in 1931 to prevent capital assets from leaving Germany. After seizing power in 1933, the Third Reich exploited the law to fraudulently divest emigrating Jewish citizens of their financial assets.

| Property | Value |

|---|---|

| Author | |

| Addressee | |

| Place of creation | |

| Format | |

| Genre | |

| Extent |

|

| Language | |

| Subject | |

| Rights | No Copyright - United States |

| Rights holder |

|

| Credit line |

|

| Additional credit |

|

| Digitization funder |

|

Institutional location

| Department | |

|---|---|

| Collection | |

| Series arrangement |

|

| Physical container |

|

View collection guide View in library catalog

Related Items

Cite as

Bredig, Georg. “Correspondence between Georg Bredig to Max Bredig, circa 1935,” 1930–1939. Papers of Georg and Max Bredig, Box 7, Folder 11. Science History Institute. Philadelphia. https://digital.sciencehistory.org/works/rh3uqew.

This citation is automatically generated and may contain errors.

Dem Steuermerkblat des Hochschulverbandes entnommen:

[Max Bredig’s hand: ungültig]

„Vermögensteuer wird nicht erhoben, wenn das abgerundete Vermögen 20000 M. nicht übersteigt. Dieselbe beträgt bis zu 30000 R.M. 3%.

Für die Einkommensteuer sind zur Abgabe einer Steuererklärung (¶61) verpflichtet Steuerpflichtige, deren Einkommen den Betrag von 8000 R.M. im Jahr übertragen hat.

Eine Veranlagung erfolgt nicht, wenn das gesamte „Einkommen“ (d.h. Roheinkommen) nach Absetzung des steuerfreien Einkommenteils von 720 R.M. den Betrag von 8000 R.M. nicht übersteigt u. lediglich in besteht, von denen der Steuerabzug vom Arbeitslohn vorgenommen worden ist.“

[Max Bredig’s hand: frech]

Wie ist das nun bei Dir?

Excerpt from the tax information sheet of the university association:

[Max Bredig’s hand: invalid]

“The wealth tax will not be raised if the approximate wealth does not exceed 20,000 Reichsmarks. The same applies for up to 30,000 Reichsmarks at 3%.

Taxpayers, whose income exceeds 8,000 Reichsmarks per year, are required to submit a tax return for income tax purposes.

An assessment will not be completed if the total “income” (i.e. gross income) after deduction of the tax-free portion of the income (720 Reichsmarks) does not exceed 8, 000 Reichsmarks and only consists of income from which the tax deduction has been earned from wages.

[Max Bredig’s hand: presumptuous]

How is it with you now?